The lease price of a car is affected by several trends and factors. Economic trends, such as inflation and interest rate fluctuations, can cause lease rates to rise and a particular lease car to no longer fall within employees' standard lease rate.

Therefore, it may be wise to index the standard lease rates. In this piece, we'll take a closer look at standard lease rates, developments affecting the cost of auto leasing, and (the pros and cons of) indexation.

Standard lease rates

Standard lease rates are a useful tool for companies to determine what kind of lease car an employee may drive. This rate is based on a monthly calculation that is often determined by factors such as the car's list value, the term of the lease, the standard mileage established in the organisation and any additional options included. It is a good way to transparently compare employees in different job levels. Standard lease rates provide clarity by setting a maximum monthly amount for which a car may be driven for each job level. This prevents discussions in the workplace by putting everyone within the same job level on equal footing. In addition, it results in fewer questions for the department that deals with the fleet.

Total Cost of Ownership (TCO)

But there are more components that determine the cost of a leased car. To get an accurate picture of the total cost of a car over its lifetime, it is important to include variable costs such as fuel and/or electricity. People therefore talk about the so-called Total Cost of Ownership, or TCO method. These costs are also included in the monthly lease amount. The TCO method ensures that the expected cost of a car is closer to the actual cost, which improves accuracy for budgeting purposes.

The benefit of the TCO method is that it gives employees a better understanding of total costs and encourages them to choose a more fuel-efficient car. After all, a car with a higher list price does not necessarily have a higher TCO. Fuel or energy costs are ultimately part of the standard lease rate, and the higher these costs are, the smaller the amount left for the employee to choose a car. That's why it pays to choose a fuel-efficient car. This also contributes to any sustainability goals an organisation may have.

In addition, using the TCO methodology allows employees to put together their own mobility package. A cheaper and/or more fuel-efficient car can be combined with an e-bike or public transportation, which is a first step toward a flexible mobility policy.

Fuel and energy price trends

An important part of lease costs are fuel and energy costs. This can be as much as a third of the total lease price.

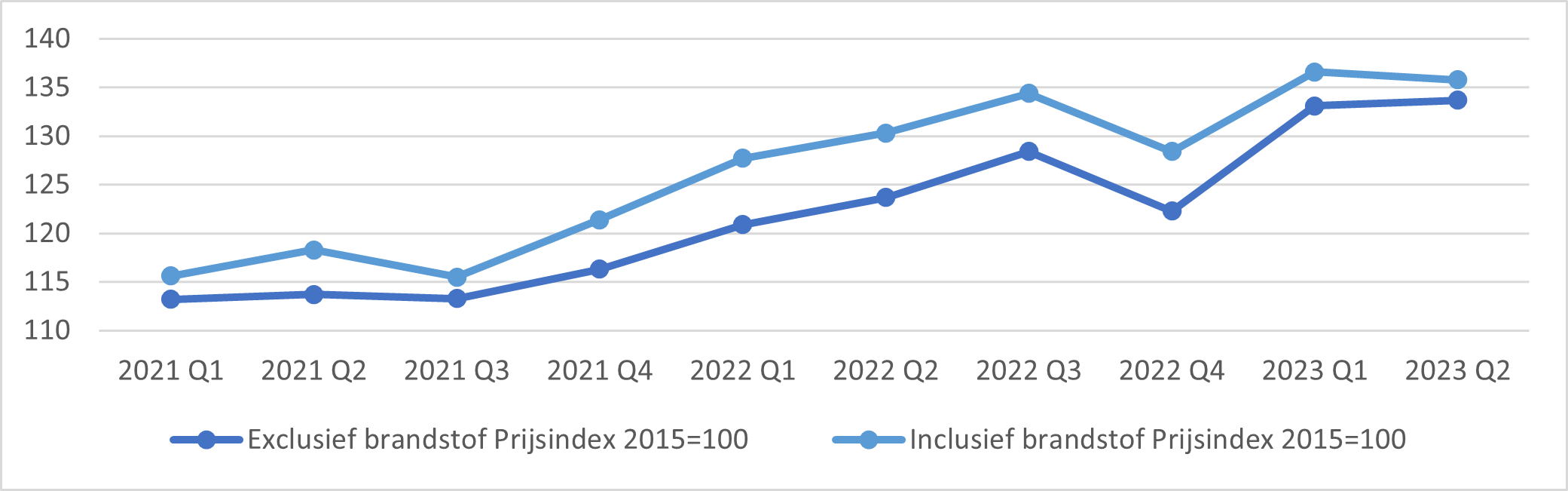

Cost development of business lease contracts | Source: CBS

After the corona pandemic, the economy began to rebound, increasing the demand for fuel and energy, resulting in higher fuel and energy prices. When war broke out in Ukraine in early 2022, these costs rose once again due to the sanctions that had been introduced against Russia and uncertain oil and gas supplies. In response, the Cabinet decided to reduce taxes on gasoline and diesel fuel as of April 1, 2022, and institute a price cap on energy as of January 1, 2023, which had a positive effect on the overall cost of a car.

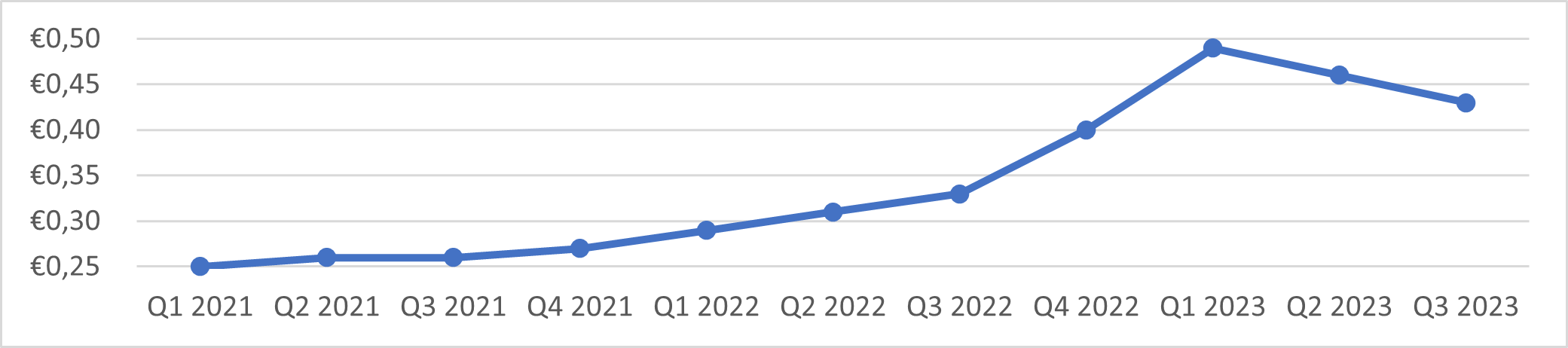

Of course, with electric vehicles, the way the car is charged then also plays a role. The rates for public charging vary widely, for example, so it is relevant to know where and how drivers charge their vehicles. Can one charge at home, or only at a public charging station? How often is fast charging done en route and is charging in the office an option? The choices a lease car driver makes in this regard greatly affect the total cost of an electric car. For proper standardisation, we use the average charging mix, which includes all forms of charging.

Electricity prices are currently showing a downward trend and the energy tax on power is expected to fall slightly in 2024. Since the price cap for households and small consumers will expire as of 2024, agreements reached by the new Cabinet and the volatility of the energy market will determine the cost of electricity.

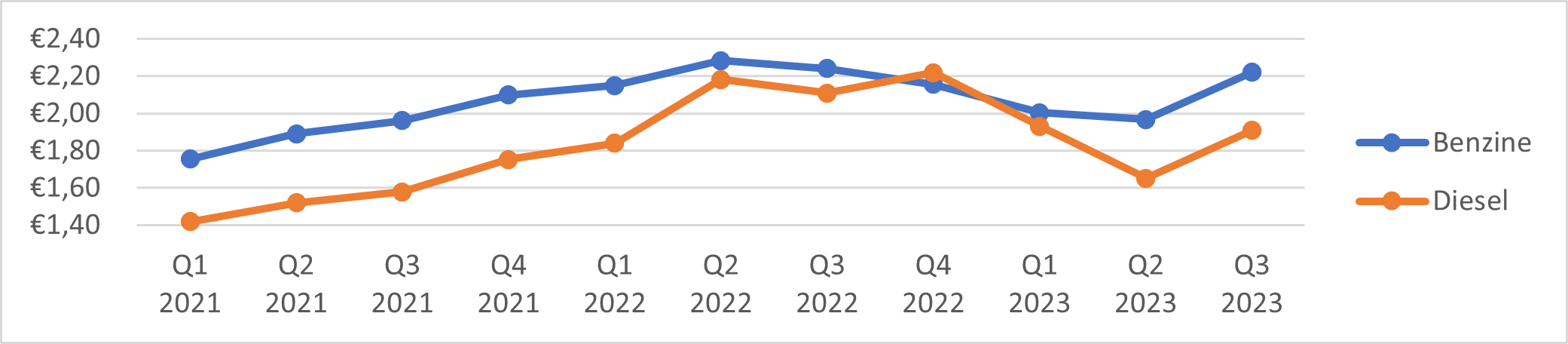

Average fuel prices | Source: own fleet

Average price per kWh | Source: own fleet

Although the fuel excise tax rebate was extended until June 30, 2023, it was subsequently phased out. As a result, the temporary drop in fuel prices has been wiped out and prices at the pump are rapidly rising again.

Car price trends

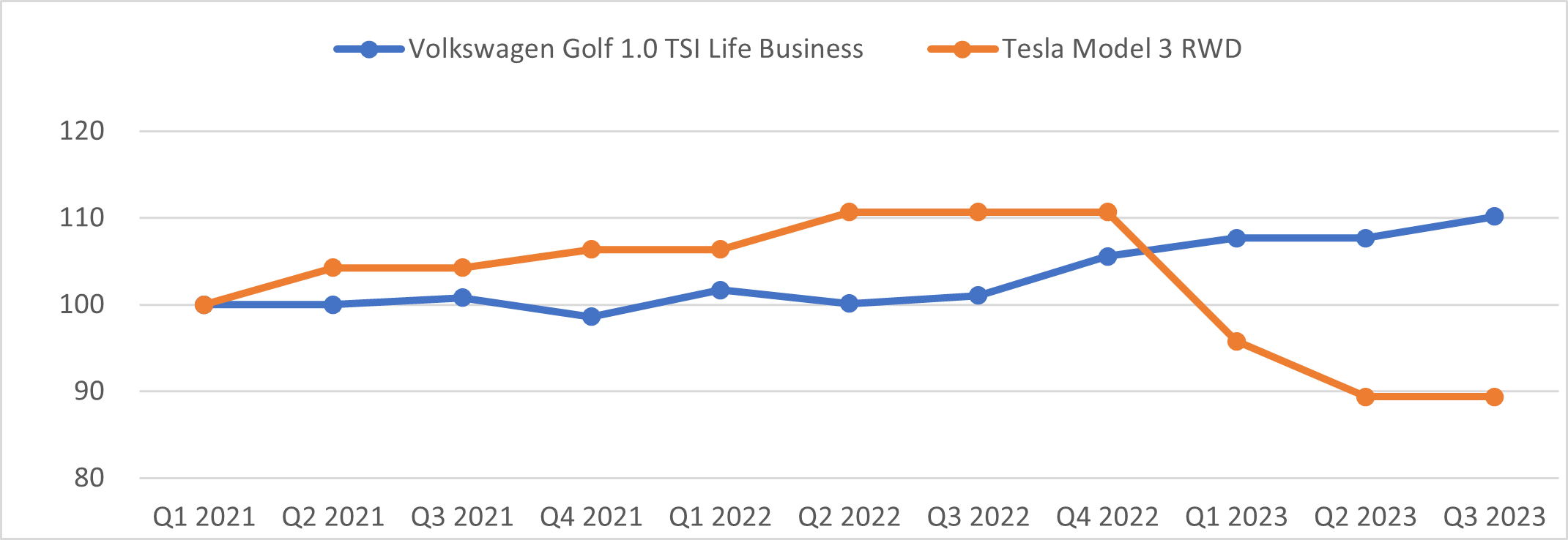

Over the past two years, we've experienced long delivery times for new cars, so the imbalance between supply and demand led to rising prices. We are just beginning to see delivery times with most car manufacturers normalise once more, resulting in supply and demand coming closer together again. In practice, this means that the list prices of cars are not necessarily falling, but importers are discounting to get rid of their inventories. Electric cars do actually seem to be getting cheaper. Since January, Tesla in particular has lowered the prices of its models, and several manufacturers are now following suit.

Price trends of two current cars | Source: car manufacturer's list price

However, the price of auto parts has risen once more. There are also higher maintenance and repair costs due to increased workshop rates. This is due, for example, to increases in mechanics' salaries - given the shortage of technical personnel in the labour market - which are then passed on. Car insurance premiums are also higher, partly in response to rising repair costs.

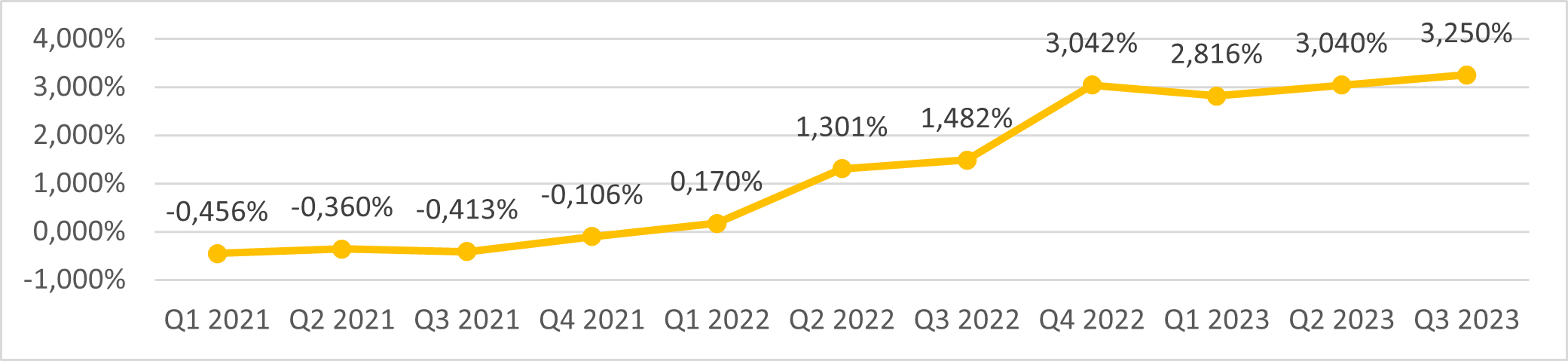

In less than two years, the interest rate to borrow money on the European capital market has risen from a negative rate to a current rate above 3%. As a result, a much larger interest component must be included in the lease rate than before. All of these developments affect the cost of a leased car.

European capital market interest rates | Source: FD

Indexing standard lease rates

Standard lease budgets have been a topic of conversation at many organisations in recent years. These budgets play a crucial role in determining the cap on lease expenditures, and the question is whether and how frequently they should be indexed. While valid arguments can be made both for and against indexing, it is important to consider the broader context and possible consequences.

Arguments for indexation:

- Inflation is a reality that affects the cost of living and cost of services. Indexing standard lease budgets allows a company to keep up with current market rates and remain competitive in their industry for attracting new employees and retaining existing ones.

- Indexing provides transparency by offering employees insight into the reasons for adjustments.

- This helps make clear whether it is possible, given the current market and associated prices, to choose a comparable car.

Arguments against indexation:

- Excessive indexation can cause fiscal problems for companies, especially if inflation rises sharply. This can result in cost overruns and possible cuts in other essential areas.

- The option to choose more expensive vehicles also leads to higher additional taxes. In order to maintain the same additional tax burden, a salary increase may be necessary.

Conclusion

The final decision on indexing standard lease budgets should be based on the needs of both employees and employers. As an employer, your goal is to control and preferably reduce mobility budgets and make your fleet more sustainable. But you also want to be able to offer your employees (similar) cars that suit them. So you have to strike a balance between employee satisfaction and cost control.

Deciding whether or not to index standard lease amounts is a complicated process. ALD Consultancy regularly works with companies dealing with this issue and has the expertise to collaborate together to see what is best for your company and employees. Our ALD Automotive advisors will therefore be happy to talk with you to see where we can provide support in this process.

We would be happy to tell you more about indexing standard lease amounts. Contact our Mobility Consultants. You can reach us by telephone on +31 (0)20 658 70 00 or send an e-mail to info.nl@aldautomotive.com.