January is not only the month of resolutions. It's also the time of year when new regulations go into effect. This is also true in the field of car taxes. For example, new tax rates for electric cars have come into effect, the BPM has been adjusted, and many subsidies have been changed, including the MIA, the EIA, the SEBA, and the SEPP.

We list them below:

Tax Rates 2022

For 'normal' cars, the tax rate remains 22%, but the tax rate has changed as of 1 January for electric cars. For a company car from 2022, you now pay a tax rate of 16% on 35,000 euros for 60 months. Is the catalogue value higher? Then you pay 22% on the difference. There is an exception for hydrogen and solar cell cars.

BPM

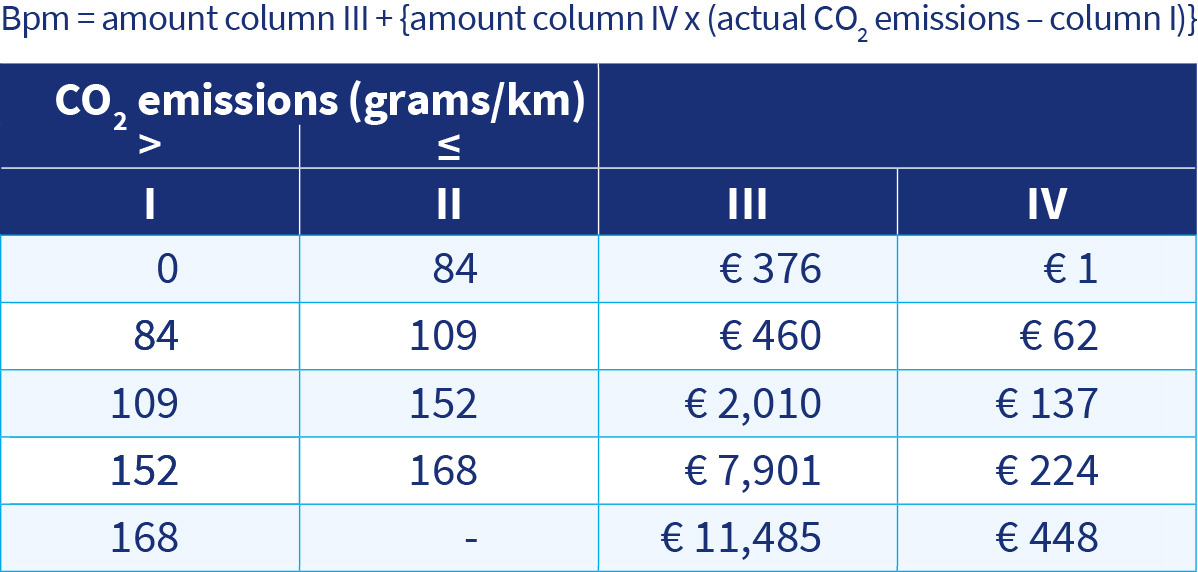

The BPM amounts (the registration tax on a new car) have been adjusted as of 1 January. Would you like to know exactly what it is like per year? If so, the Tax and Customs Administration has an overview for you in which you not only find the rates for this year but also for all previous years. In order to save you some searching, we have placed the table below for 2022:

The CO2-dependent rates for passenger cars (other than plug-in hybrid cars) can be read from the table below.

For diesel cars, the outcome of the table is increased with a diesel surcharge. This applies above 75 grams/km and has a rate of € 86.67 per gram of CO₂ emissions.

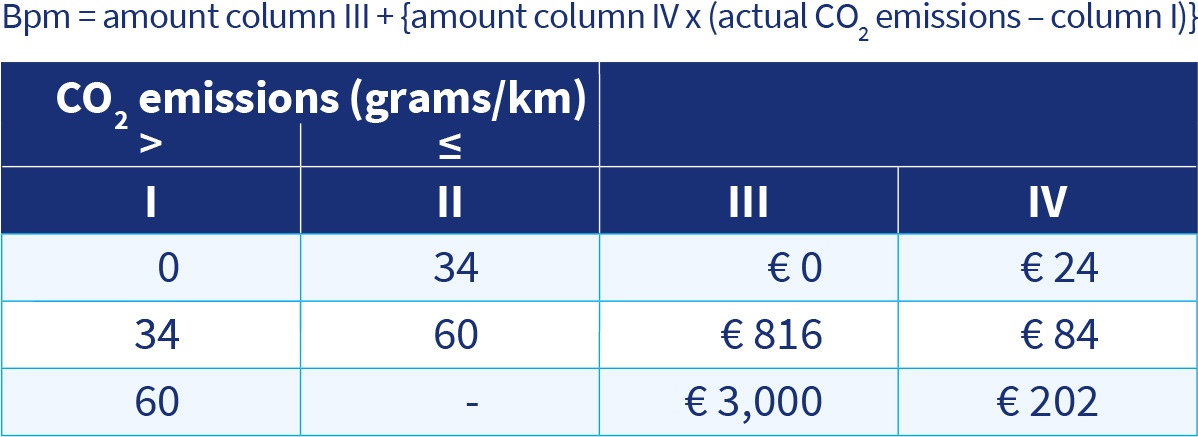

The table below applies to plug-in hybrid passenger cars.

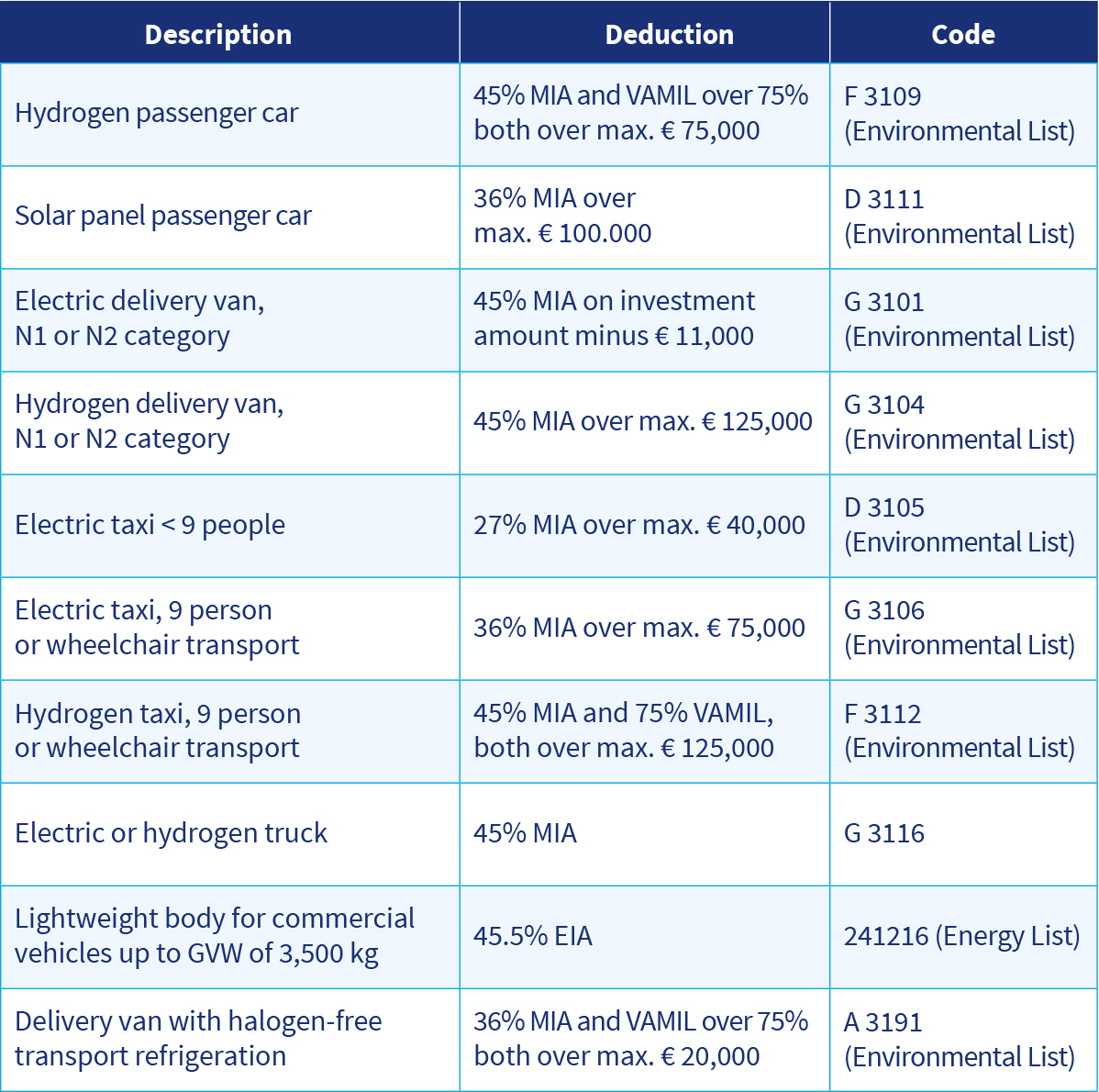

MIA (environmental investment allowance)/EIA (energy investment allowance)

The environmental investment allowance has risen sharply this year. In the overview below, we have listed a number of cars for which you can apply for this allowance. Look for the full list and conditions on the RVO website.

SEBA/SEPP

The subsidy for zero-emission company cars (the SEBA) and the subsidy for the private purchase of an electric car (the SEPP) have also been adjusted. For example, as an SME, you will receive a 12% subsidy when purchasing an electric delivery vehicle. As a private individual, you receive a subsidy of €3,350 or €2,000 from the government when purchasing a new or used electric car. Of course, this is subject to the necessary conditions and limits. The subsidy is quite popular, and applications are pouring in. So don’t wait too long!

Source: Auto en Fiscus